Fuel Card Optimiser

There are 940,000 UK company car drivers and around 170,000 of these receive free private fuel, i.e. where the company pays for both the private and business fuel and this is reported on the employees’ P11D as a fuel benefit in kind.

Every year the cost of providing the private-fuel benefit becomes greater, due to increases in the CO2% of company cars and the private-fuel benefit scale multiplier.

Although private-fuel is still a popular historic benefit among employees, it is universally accepted that in most cases (unless you are driving substantial private miles per year) this is a costly benefit for both the employee to receive and the company to provide.

As an alternative to the fully-expensed company car, we have developed an employee friendly way for staff to keep their fuel cards but without the high associated costs.

Our private-fuel solution reduces the cost of providing a fuel card by over £1,500 per driver per annum i.e. over a typical three year lease we can reduce the whole life cost of providing a fully fuelled car by about £4,500.

We work in collaboration with companies to implement our service in a smooth and risk-free way, that ensures the maximum savings for both the company and employees.

Today, many of the UK’s and Europe’s best-known companies and over 15,000 of their employees have benefitted from our fuel card planning service and trust our expertise.

Over a decade of experience and expertise in the delivery of our fuel card planning solutions has meant that we are the UK’s market leader in this field.

It speaks volumes that our very first private-fuel client (a £2billion+ international construction company) back in 2008, is still a delighted client today.

If you have employees who currently have a company car and a fuel card, please get in touch.

Electric Vehicles (EV)

As EV’s become more prevalent in society, we have a number of services and solutions to help clients as they transition their fleets to electric.

From policy writing to expense reimbursement, we have the knowhow and technology to assist you every step of the way.

Whether you are looking to reimburse business mileage expenses at the HMRC AER rate, the actual rate of the cost incurred or alternatively pay for all electricity (home, work and public charging) and require employees repay any private costs to the company, we have the solution to suit you.

If you would like to learn more or have a chat regarding your current policy/procedures, please contact us at EV@innovationllp.com

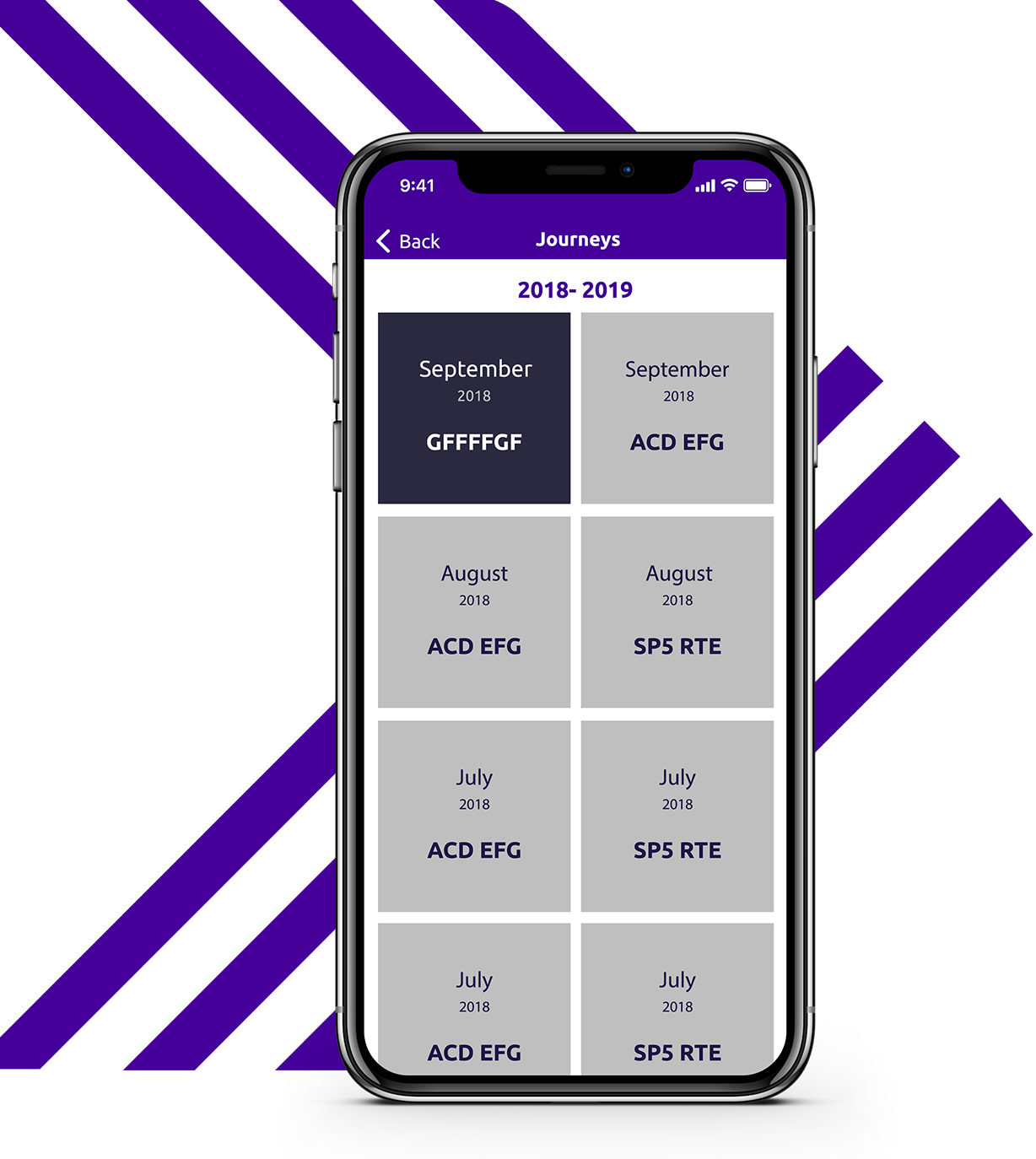

Mileage Capture

With our mileage capture solution, you can be rest assured in the knowledge you will be HMRC compliant with your mileage expenses. You can have confidence that it has been designed by some of the UK’s leading tax experts on car benefit and mileage expenses.

Our mileage system is built using the latest technology and includes the main Smartphone operating systems to allow employees to easily record business journeys using drive detection technology, the GPS stop/go features or manually input the business journey at a later time or date.

One area where we major more than any other mileage system company, is a service where we professionally review every business journey to a standard at least as high as the HMRC threshold. This belt and braces approach provides a level of compliance that no digital app or spot-checking service can come close to – it is the gold standard in mileage capture services.

If you would like to know more, please contact us.

Business Mileage Only (BMO)

Our ‘Business Mileage Only’ option on our award winning Traxmiles system gives users the ability to record their business mileage journeys but without the need to enter any odometer readings.

Each client is able to choose a specific monthly date by which mileage submissions must be made to meet the corresponding payroll deadline.

Any mileage entered on Traxmiles will be professionally reviewed by Innovation to ensure full HMRC compliance before any expenses or payroll entries are made, as well as ensuring compliance with the client’s internal car or expenses policy.

BMO is an ideal solution if you are looking to reimburse business mileage expenses to your employees in a timely and in an HMRC compliant manner.

Many mileage systems force drivers to stick to a monthly routine, including Nil returns. With the BMO functionality drivers are free to enter their mileage as frequently or infrequently as they wish, giving drivers more flexibility and reducing the number of mileage returns that need to be made.

BMO also makes it easier for drivers to swap between different cars, again saving time and making the experience easier and quicker for users.

Cash Allowance Drivers

Cash allowances have long played a key role in employee benefits packages as an alternative to a company car, or to cover employee business travel costs.

With increasing taxation on company cars, and a perceived higher cost for each employer, there has been a shift by some companies to move away from the company cars and offer a cash alternative. According to data released by HMRC there was a 20,000 company vehicle reduction in 2016/17.

Our cash allowance advice has helped many companies who are looking for an employee and HMRC friendly way of boosting employee net take home pay and reducing operating costs for the employer.

The enactment of Optional Remuneration Arrangement (OpRA) legislation in 2017 has created new challenges to many companies and made life more difficult for them where a cash allowance is offered. We are there to help clients find the best solution to suit their needs, as well as mitigating the risks and costs of OpRA.

If you have a high population of cash allowance drivers (100+) we would love to hear from you.

Claiming back National Insurance Contributions

If your company has a high number of employees who received a cash allowance, you may be entitled to a claim Employer NIC relief/refund for the last 6 years. The claim relates to business mileage, that was paid to cash allowance takers, at below the maximum NIC free rate of 45 ppm.

This could be worth as much as £1,000 per relevant employee, covering a six-year time-period.

You may have heard of this referred to as Total People, or Cheshire Employer and Skills Development Limited or RME claims. During the Tribunals, the Courts upheld the understanding that part of a car allowance should be NIC free, in the right circumstances.

Peter and John have followed this case closely, have written several articles on its merits and even attended court proceedings – so we are extremely well placed to support companies with these claims.

We have filed many protective claims on behalf of some of the UK’s largest companies in the confidence that these taxpayers will receive a NIC refund.

We are aware that many other companies (non-clients) who had originally submitted protective claims have since capitulated and withdrawn their claims. We strongly advise those companies to get in touch with us so that we can revive those claims and still generate a windfall saving for you.

Because of the statute of limitations, you should ideally move quickly and file your protective claim with us.

If you have over 100 cash allowance drivers, please get in touch – we can help you.

De-risking and Business Mileage

HMRC compliance is at the heart of everything we do.

All our solutions require accurate, timely, complete and HMRC compliant business mileage records. Our technology and services have been built around these requirements first and foremost.

Our business mileage solutions enable users to easily and conveniently record their business journeys via a PC or using the latest main Smartphone operating systems and GPS technology.

Employees and employers can be safe in the knowledge that, by using Innovation, they are being looked after by the UK’s most HMRC compliant mileage capture solution provider.

Peter and John sit on employment taxes technical sub-committees for both the Chartered Institute of Taxation (CIOT) and The Institute of Chartered Accountants in England & Wales (ICAEW).

To ensure compliance above and beyond HMRC’s expectations, every business journey that is recorded on our mileage system by one of our clients’ drivers is professionally reviewed (as an HMRC inspector would review them) by our advanced software and also by one of our dedicated client team managers.

Our belt and braces approach means that our clients may rest assured that business mileage can be safely supported to the highest standards and rigours imposed by HMRC.

By becoming a client of Innovation your risk profile will greatly decrease whilst significantly increasing compliance.

If you would like to discuss a risk and compliance review of business mileage expenses, then please contact us.

As a result of the high quality mileage review checks which we undertake all our clients find that the number of business miles recorded and processed actually drops and so there is an inherent cost reduction in what employees claim, which then helps to pay for the cost of our service. Our mileage system is therefore self-funding with immediate payback for all our clients.

Switching between Cars & Cash

With the UK government targeting company cars as a revenue source through increased taxation and additional cost burden to both company and employee, some companies have reached their tipping point. This has resulted in a shift towards offering a cash allowance instead of providing a company car.

That said, before you make this decision, the total cost of ownership should be considered together with the tax implications. Offering a choice between cash or car can serve as a positive stimulus for recruitment and retention, it can also mitigate risks around grey fleet management and corporate manslaughter.

But all that glistens is not gold and so we would encourage companies to look at our alternative solutions first before necessarily switching to a cash alternative.

VAT on Cars and Mileage

Astonishing as it may seem, we constantly find companies that are not reclaiming the correct or full amount of VAT on fuel, mileage and cars.

The VAT rules on cars and mileage are quite specific and are not necessarily easy to follow.

Innovation can help you navigate through the maze of complex rules and improve compliance and savings at the same time.

Please contact us if you have a query or require any help in this area.

Optional Remuneration Arrangement (OpRA)

New legislation came into force in April 2017 regarding how Benefits in Kind are to be valued where a cash alternative exists. Some employee expenses which were tax-free pre-April 2017 might now not be tax-free if in any way connected with a cash alternative.

The Optional Remuneration Arrangement (OpRA) rules came into effect from 6 April 2017 following HMRC concerns about the increasing use of salary sacrifice and the potential loss of tax and NIC receipts to the Exchequer.

The legislation is still ambiguous in some areas. This ambiguity and complexity mean that companies need to take great care on how they administer their car policies and comply with these rules as the tax and NIC treatment of benefits has become increasingly complex.

The legislation is not only complex, with a number of grandfathering arrangements, but can also lead to opportunities with proactive planning and with the best external advice.

To find out more please do not hesitate to contact us.

Carbon Dioxide Reporting

The Government announced its plans for the new Streamlined Energy and Carbon Reporting (SECR) regulations that apply to all large companies from April 2019.

We can help companies to comply with the transport element of the Scope 1 (direct emissions) regulations. Other environmentally focused companies may also take advantage of our Carbon Dioxide reporting suites.

Policy Reviews

After providing advisory services to many large corporate fleets over the last decade, we can help with your company car and cash allowance policies.

Our in-depth technical knowledge of employee benefits relating to cars, fuel and tax/NIC legislation means that we can help you devise an optimised car policy and guide you through the minefield of legislation, whilst helping to protect you from OpRA mantraps amongst other things.

Benchmarking

We are able to provide benchmarking services for best practice, mileage expense processes, company car policy, salary sacrifice, environmental impact and employee benefits.

We can compare your business processes, performance metrics, company car and expense management against peer groups and the rest of the UK, to improve staff recruitment and retention whilst saving costs and minimising risk.

Employment Tax and National Insurance

Peter and John sit on Technical Committees of the CIOT and ICAEW and are heavily involved in lobbying Government for positive change as well as vetting and commenting on new or proposed Income Tax and NIC legislation.

If you have any burning questions or you would like a second opinion on these taxes, then please do contact Innovation for a free initial consultation.

Mileage Capture

We have developed a very user-friendly and the UK's most compliant mileage capture system, to enable risk free and easy business mileage recording. With a suite of the latest Smartphone apps, recording business mileage couldn't be more straightforward.

Find out moreDon’t just take our word for it

Firstly can I thank you for your assistance, guidance and understanding in helping me with this matter. The service I have received from you has been first class and you have been a pleasure to deal with. I was very upset when we first made contact due to the increased deduction that was taken this month and although that has happened now, what you are now suggesting moving forward makes sense…….even to someone like myself who was really struggling to understand the system. It is very rare in this day and age that you have the benefit of dealing with someone who calls you when they say they are. You have followed up all our conversations with a fully informative email too. I was very set to ask to step out of the scheme, and although I still have my concerns with how my new working pattern is going to work, its thanks to you that I am going to continue for the time being. Thank you again Helen, I appreciate all your help so far, and look forward to working with you over the next few months and hopefully more.

Vicky,

“In my role as Financial Director there has been very little for me to do as the whole process is being managed in its entirety by the team at Innovation. They provided a very clear project plan, as well as taking time to explain in detail how the initiative would operate to all stakeholders. They delivered a smooth implementation, ahead of schedule to meet our internal deadline for payroll and have continued to support the business through the first few months of the change in process."

Hitesh Nathwani, Finance Director, Agility Logistics Limited

Read story

“We have just been through our second full year with this arrangement in place, and we are seeing savings to the business of over £1,200 per driver, per year compared with the costs of providing fuel under the fuel benefit. In addition, this year saw 60% of our drivers save on average £580 compared with the tax they would have paid on the fuel benefit, so the arrangement is popular with staff as they can see the benefits it brings.”

Alan Murphy, Group Finance Director, Agnew Group (part of Sytner)

Read story

“Innovation’s client service has been second to none. In addition to a willingness to invest time in explaining to a non-tax audience in order to assist management in selling the benefits of proposals, they have been particularly effective in working with non-tax personnel. This has been seen to best advantage in the way they have won over sceptical HR Operations personnel through attention to detail, speed of response and keeping to promised deadlines.”

Robert Fort, Group Head of Tax, Amey plc

Read story

“With any new change of policy a few challenges will inevitably arise but the tax team at Innovation have been and continue to be proactive and quick to assist in addressing these to ensure that the project is a complete success. I am pleased to have had the opportunity of working with Innovation on this innovative and specialised tax project where they truly excel – it has been a thoroughly enjoyable experience for me.”

Martyn Sandford, , Group Financial Controller, Anglian Windows Ltd

Read story

“Fuel Card Optimiser was not particularly a ‘tax led’ project for Biffa. The stakeholder team was very large and of a multi-disciplinary nature. Innovation proved time and again their specialist knowledge in this overall project area and took time to explain in great detail to the whole project team and the relevant stakeholders the fundamentals of FFO and the legal framework in which it sits. They made this complex area of law very accessible to experts and non-experts alike."

Julian Bowden-Williams, Head of Tax & Treasury, Biffa Limited

Read story

“I’ve loved working with you guys at Innovation and introducing C-Fuel was one of the best things we have ever done at CEVA. From being viewed with suspicion, it’s become really popular. Everyone at Innovation has been brilliant to work with, always helpful and knowledgeable. I hope to work with you again in the future!”

Leanne McLean, Senior General Manager, CEVA

“CSM implemented the Fuel Card Optimiser arrangement in April this year for all company car drivers who have the benefit of a fully expensed fuel card. Kate and her team have provided a high quality of service throughout and are always available for help and support. We look forward to continue to work with Kate and the team at Innovation and would definitely recommend them to others."

Sharon Brown, Employee Services Adviser, CSM bakery Solutions

Read story

“Three years on we are so pleased we went with Innovation. WE have had near enough 100% take up from staff thanks to clear communications and webinars, which Innovation hosted and were more than willing to take questions from drivers around the personal impact of the arrangement on their position. There has been very little for us to do as the whole process is being managed in its entirety by the team at Innovation. What little feedback we’ve had from employees has been entirely positive.”

Vikki Barker, HR Business Partner, DB Schenker Ltd

Read story

“Some staff were initially sceptical – in view of the fact that this idea is so innovative – but after Innovation did their road show presentation all staff were very comfortable with the concept. Innovation even sat down with individual employees who had personal queries on a 1:1 basis to help explain how their tax codes operated. We have consequently seen driver habits change for the better in that staff are now driving more efficiently to maximise MPG and are even car sharing.”

Mark Townsend, Managing Director, Derry Building Services

Read story

“Looking back, we are pleased we went with Innovation and implemented their Fuel Card Plan. During our discussions, it was clear that Innovation were extremely credible and experienced in this area and were the only firm willing to indemnify us and provide all the warranties and safeguards we required. The positive feedback I have received from our employees has been extremely reassuring.”

Mel Pearce, People Services, DFS

Read story

“We are a family firm and apart from considerable reduced operating costs, our employees’ welfare is incredibly important to us, so when John shared with me that many of our staff would also be better off, we quickly approved the implementation – their proposition was that compelling. We are delighted with the system, the savings and how Innovation looked after Drayton and its staff"

Simon Miles, Group Finance Director, Drayton Group Ltd

Read story

“We believe that the system has delivered exactly what we were told it would and we are on-course to make significant savings to the business. As with any new system this required a lot of forward planning to ensure the roll-out went smoothly and Innovation were on hand at all times to ensure the new system was introduced as efficiently as possible. We would have no hesitation in recommending Innovation to other businesses or indeed working with them again in the future on other products.”

Chris Elvidge, Finance Director, Drive Vauxhall

Read story

“Innovation is also a very ethical firm. They pride themselves on complying not only with the letter but also the spirit of the law and have a number of ways to ensure that there is always ‘clear blue water’ between what they do and what is expected from HMRC, thereby proving that you don’t have to be aggressive or risk taking to save tax: just innovative and smart. I would have no hesitation in recommending Innovation and their tax team to any business.”

Mark Faulkner, HR Director, EH Smith

Read story

“We have been very impressed with the consistent high level of customer service they have provided. The team have a great deal of expertise and specialist knowledge and immediately understand the needs of an organisation both in the short and long term. In summary, the service has been second to none and we would certainly recommend them as a reliable and customer focused company.”

Sally Gregory, Human Resources Director, Europcar Group

Read story

“Because the whole process has gone so smoothly from the outset, we have actually needed very little face-to-face time with Peter. He is always available at the end of the phone no matter what the query and the whole service has taken up far less management time than we first envisaged. This is only our first year but we are track to make very sizable savings for both ourselves and the employees.”

Marcus Lamont, HR Director , Everest Ltd

Read story

“We have achieved a 100% compliance every month from day one. All the drivers submit their monthly mileage logs on time. Innovation check every single journey for compliance and train/educate drivers where appropriate. We would be pleased to endorse Innovation and recommend them to others. We have found Innovation to particularly knowledgeable in this area compared to others as well as highly professional."

David Lowe, Head of Procurement, Fowler Welch

Read story

“We made considerable gross savings thanks to the Fuel Card Optimiser solution in-line with Innovation projections. Importantly, all our employees are either cost neutral or in many cases are better off than before. I am happy to recommend Innovation Professional Services to other construction firms in particular and indeed to all businesses in general."

Peter Rose, Shared Service Director, Galliford Try

Read story

“They presented us with an idea that would save circa £1,000 per year for each member of staff who received the private fuel benefit. I am naturally risk averse and cautious with any new supplier, but after meeting John it gave us the confidence to move forward quickly. WE are nearly 2-yrs in – Innovation have done everything the said they would do and more. I couldn’t speak more highly of them.”

Jimmy Bradley, Deputy Finance Director, Kelly Group

Read story

“The employment tax solutions outlined by Innovation were closely aligned to a key challenge the business was facing, namely, how to carry on providing fuel cards in a way that was much more cost effective. Innovation are different not only because of their innovative ideas but also because of the combination of their commitment to their clients through the whole project, their responsiveness, easy access to the senior team and the way in which their ethos can be seen through the entire team.”

Douglas Briggs, Finance Director, Accounting & Reporting, Kuehne + Nagel

Read story

“The success of the project so far has been partly due to the neat concept of the arrangement itself, but more importantly in my view, the quality of the Innovation team. It is the rare combination of technical knowledge, strong personal experience, a pragmatic approach and the human tough which make them so good at what they do.”

Ralph Steward, Head of Reward, Laing O’Rourke

Read story

“They brought us a new and innovative cost saving idea to us, which we have not seen being supplied by anyone else, even though we deal with a range of professional advisers. The system has been designed to be fully HMRC compliant. If any company is still providing free or private fuel to their employees, I would also encourage to talk with one of the advisers at Innovation.”

Phil Myers, Group Internal Audit Manager, Lookers plc

Read story

“The arrangement delivers savings for both the company, which are significant and also ensures that also benefit, or at the very least are no worse off whilst helping the company save cost. The team at Innovation have been professional throughout, producing high quality employee communications and dealing promptly and thoroughly with any queries that have been raised through the transition process as we launched the product. We would have no hesitation in recommending them to others.”

Catriona Smith, Head of HR, McNicholas

Read story

“Under the new arrangement our staff get to keep their fuel cards but the cost to us of that provision has been reduced by over £1,000 a head. The solution does require the collation of business mileage records but staff are happy to do this because they understand the benefits to the business as well as themselves.”

Gordon Shepherd, Finance Director, Osborne

Read story

“We are pleased to work with the people at Innovation to optimise the arrangements on the use of fuel cards in our business. Based on our experience on fuel cards, I would be very happy to endorse working with Innovation on similar projects. We found them to be straight talking individuals and delivered on time and to budget. And now I can only question why we took so long to give it the go-ahead.”

John Hamilton, Group Taxation Director, Stagecoach Group

Read story

“The success of the project has been due to the excellent client service and detailed tax knowledge and skills provided by the Innovation team. Innovation produced employee communications and developed payroll processes with 100% take-up and buy-in from our staff, including on-going administration. There is no incremental work as employees claiming back business mileage through expenses enter exactly the same details now as they did before."

David Freestone, Programme Director, Willis Towers Watson

Read story

“Innovation first helped us following an HMRC review into our process concerning business mileage record keeping for drivers reimbursing mileage. They presented a compelling proposal, which had the added benefit of removing much of the administrative work from the company, as well as ensuring that the work was done in total compliance with HMRC’s guidance and the legislation around fuel reimbursement.”

Adrian Evans, Head of HR ESS Operations, Wincanton

Read story